A Credit Information Report (CIC) is a concise summary of transactions made by both individual and corporate customers. It is also referred to as the CICL report. The report is used to assess the financial discipline of the customer about their repayment history, credit facilities utilized, amount of loan, and tenure. It contains comprehensive data regarding credit customers.

Karja Suchana Kendra Limited is a Credit Information Bureau of Nepal which is owned by Banks and Financial Institutions. Its main function is to collect data on credit customers from banks and financial institutions. Upon request, it generates CIC reports of both consumer and corporate customers to its members for credit-related decision-making purposes. This data is used to analyze and evaluate the customer's creditworthiness.

Further, the regulatory body, NRB has made it mandatory to send the CIC report of the credit customers to Karja Suchana Kedra and must inquire about the CIC report before disbursement, renewal, or any credit-related purpose. General banks and Financial institutions submit reports of the customers at intervals of every 30 days.

In this article, we will discuss the importance of CIC report data in determining creditworthiness and understanding the data reflected in the report.

Scoring Details or Credit Score:

The CIC report provides a detailed analysis of individuals' or commercial clients' creditworthiness, which is reflected in their credit scores. The score indicates how creditworthy the customer is and reflects their financial behavior in terms of repayment of credit facilities. By analyzing the data, CIC reports determine the probability of default in the next 12 months, based on the customer's 15-month credit history.

The clients are categorized into 5 categories in generated CIC reports:

1. Risk: Score from 60-180

2. Severe: Score from 181-360

3. Prime: Score form 361-540

4. Ultimate: Score from 541-720

5. Elite: Score from 721-960

The creditworthiness of a customer is evaluated primarily based on their credit score in current banking practices.

Factors that Impact Your Credit Score:

Your repayment behavior is a significant factor that can impact your credit score. It's important to make payments on time, as agreed upon earlier. Late payment habits can directly affect your CIC reports, indicating carelessness and lack of accountability towards the credit facilities you've availed. This can lead to a deterioration in your credit history and a decrease in your credit score.

The CIC reports provide information about your outstanding EMI/interest and payment history. This information is analyzed by Banks and Financial Institutions when you apply for credit facilities.

Asset Classification:

The CIC reports also reflect the classification of the availed credit facilities.NRB has classified the credit facility into two categories.

1. Performing Loan:

- Pass Category: Ovedues up to 30 days

- Watch List Category: Overdues from 30 to 90 days and expired credit facilities.

2. Non-Performing Loan (NPA):

- Sub-Standard: Overdue from 3 to 6 months

- Doubtful: Overdue from 6 months to 1 year.

- Loss/ Bad Loan: 1 year and above.

There are other provisions for the classification of credit facilities as per NRB Directives. For more details Visit here.

The classification of the loans you have taken out, as reflected in the Credit Information Corporation (CIC) reports, plays an important role in determining your ability to repay your bank's obligations. This information is taken into consideration when providing credit facilities to both new and existing customers. PASS category credit facilities are considered to be good ones and have a positive impact on your creditworthiness.

Blacklisting Indicator:

The CIC report shows whether you have been blacklisted by any bank or financial institution. You can be blacklisted for various reasons, not just credit problems. This information doesn't affect your credit score, but it does have a negative impact on your creditworthiness. You can learn more about Blacklisting here.

Other Information reflected in CIC reports:

Personal Information:

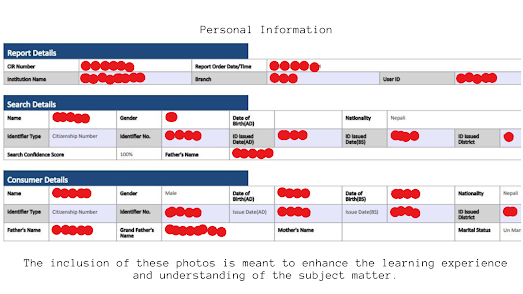

Your Name, Date of Birth, Citizenship Number, Issue Date, and Father and Grandfather's Name are mentioned in the generated CIC report.

Credit Details:

The creditworthiness of a customer is evaluated by deeply analyzing their credit information before making any credit decision. Proper understanding of the reports provided by Credit Information Companies (CIC) helps banks and financial institutions make informed decisions. However, regulatory authorities have made it mandatory to request CIC reports of the customer before any loan assessment.

Having a good credit score, a satisfactory history of repayment, and a record of transactions in your account are significant factors that play a crucial role during the credit approval process. No lender wants their customers to default on their loan payments, hence it is essential to evaluate a customer's creditworthiness before approving their loan application. This helps to avoid categorizing the loan accounts as Non-Performing Assets (NPA) in the future.

How to Increase Credit Score?

Being a lender always has a positive response towards the clean CICL reports. Here are some tips to enhance your credit score.

Timely repayment of your obligations to the bank is just one step towards improving your credit score. It is important to make timely payments of your EMIs and interest obligations, as well as keep track of your credit card dues. Renewing the overdraft facility and making timely repayments can help you create a positive credit history. When you repay your loans on time, other factors that affect your credit score will automatically be rectified.

Do lower credit scores in your CIC reports prevent you from getting loans from other BFIs?

Before processing any loan application, the lender assesses the CIC report, which provides information on the credit history of the applicant. A fresh and clean CIC report is always preferred over a deteriorated one, which may contain negative information. However, if the applicant has a justifiable reason for lower scores, the bank or financial institution may still consider their request.

.png)

.png)

0 Comments